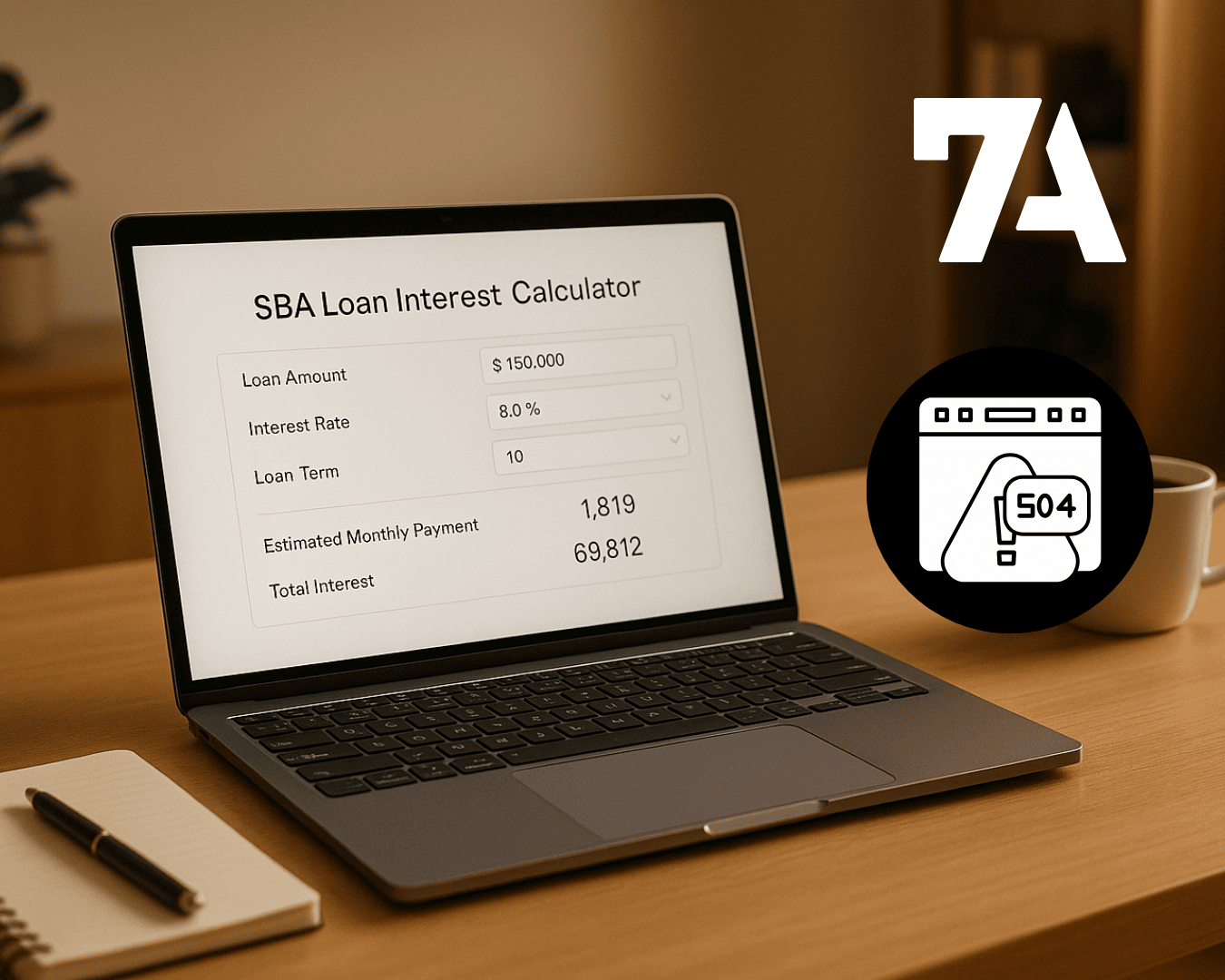

Acquiring a business is a significant milestone, and securing the right financing is crucial to making your entrepreneurial dream a reality. The Small Business Administration (SBA) offers two popular loan programs—SBA 7(a) and SBA 504—that can provide the funding needed for your acquisition. However, qualifying for these loans requires meeting specific criteria. This guide will help you understand the qualifications for each loan type and how to ensure your business is ready to apply.

SBA 7(a) Loan Criteria

The SBA 7(a) loan program is the most commonly used option for business acquisitions, offering flexibility in terms of how the funds can be used. To qualify, your business must meet the following criteria:

- Business Size: Your business must be considered small according to SBA size standards, which vary by industry. Typically, this means having up to 500 employees or annual receipts up to $7.5 million for most non-manufacturing businesses.

- Nature of Business: The business must operate for profit and be located in the United States or its territories. Certain types of businesses, such as non-profits and those involved in illegal activities, are not eligible.

- Use of Proceeds: SBA 7(a) loans can be used for various purposes, including working capital, purchasing equipment or inventory, buying real estate, refinancing debt, or acquiring a business. The SBA will review your intended use of funds to ensure it aligns with their guidelines.

- Creditworthiness: You and your business must demonstrate strong creditworthiness, including a solid credit score (typically a minimum of 680), a comprehensive business plan, and sufficient cash flow to repay the loan.

- Equity Investment: While there is no strict equity requirement, showing that you've invested your own money into the business demonstrates your commitment to its success.

- Collateral: For loans above $25,000, collateral may be required, although a lack of sufficient collateral won’t necessarily disqualify you.

- Eligibility of Ownership: Owners with a 20% or more stake in the business must provide a personal guarantee, meaning they are personally liable if the business defaults on the loan.

SBA 504 Loan Criteria

The SBA 504 loan program is designed for businesses that need to make significant fixed-asset purchases, such as commercial real estate or heavy equipment. The qualification criteria are slightly different from the 7(a) program:

- Business Size: Similar to the 7(a) program, your business must meet SBA size standards. The 504 program is often used by slightly larger businesses needing substantial asset purchases.

- Net Worth and Income: The business must have a tangible net worth of less than $15 million and an average net income of less than $5 million after federal income taxes for the two years before the application.

- Use of Proceeds: SBA 504 loans are specifically for purchasing fixed assets like real estate or equipment and cannot be used for working capital, inventory, or debt refinancing.

- Job Creation or Public Policy Goals: Your business must create or retain jobs, typically one job for every $75,000 of loan proceeds, or meet specific public policy goals, such as energy efficiency or location in a qualified area.

- Collateral: The loan is typically secured by the asset being financed, with the SBA placing a lien on the property or equipment.

- Personal Guarantees: As with the 7(a) program, personal guarantees are required from owners with a 20% or more stake in the business.

- Down Payment: A down payment of around 10% of the total project cost is usually required, though this can be higher depending on the project's risk.

Factors That May Disqualify Your Business from SBA Loan Approval

While the SBA loan programs offer valuable financing opportunities, several factors can prevent your business from qualifying:

- Poor Credit History: A low credit score or a history of late payments, defaults, or bankruptcies can significantly hinder your chances of approval. SBA lenders typically require a minimum credit score of 680.

- Insufficient Cash Flow: Your business must demonstrate sufficient cash flow to cover loan payments in addition to existing obligations. Unreliable or incomplete financial statements can also raise concerns for lenders.

- Lack of Collateral: While the SBA does not always require collateral for smaller loans, larger loans, especially 504 loans, often require sufficient collateral to secure the loan.

- Unqualified Business Type: Certain industries, such as non-profits, speculative businesses, and those with a history of legal issues, are ineligible for SBA loans.

- Inadequate Equity Investment: For SBA 504 loans, a down payment is typically required. If you cannot contribute the necessary equity, this may prevent you from securing the loan.

- Prohibited Uses of Funds: SBA loans must be used for specific purposes. Attempting to use the funds for unauthorized purposes, such as personal debt refinancing or speculative real estate, will disqualify your application.

- Excessive Debt: A high existing debt load can make lenders wary of extending additional credit, as it raises concerns about your ability to repay the loan.

- Ownership Issues: The business must be owned by U.S. citizens or legal permanent residents. Additionally, all owners with a 20% or greater stake must be willing to sign personal guarantees.

- Incomplete or Inaccurate Application: Submitting incomplete or inaccurate documentation can lead to delays or outright rejection of your application.

Preparing for SBA Loan Success

Understanding and addressing these criteria before applying for an SBA loan can significantly improve your chances of securing the financing you need. At Clearly Acquired, we specialize in helping businesses navigate the complexities of SBA loan applications. Our platform offers advanced tools and integrations to ensure your business is SBA-ready, from financial modeling to credit assessment and beyond.

Ready to take the next step in your business acquisition journey? Explore Clearly Acquired today and learn how we can support your path to success.

.png)

.png)

%20Loan%20Application%20Checklist.png)